Airmango

Lead investor │ Equity offering │ Iceland

Please note this is only a lead investor fundraising prior to the main fundraising on Funderbeam. See terms. We have decided to have fixed terms so we can keep our focus on the important development and operation we are dealing with on daily basis.

Airmango - creating experiences that leave impact

Introduction

Airmango Group is a travel company in Iceland focusing on creating travel experiences that leave an impact. Headquartered in Reykjavik, it operates one of Iceland’s top 20 travel agencies, the world-famous glamping brand – The 5 million Star Hotel – and Iceland’s first Tesla car rental with 100% electric vehicles.

It’s best known for its 19-room glamping hotel (The 5 Million Star hotel) that is debt-free and built without any help from investors. On average, the investment to build a normal 19 room hotel in Iceland is around USD 4.5 mln. This gives a good taste of the type of opportunity we are working with here.

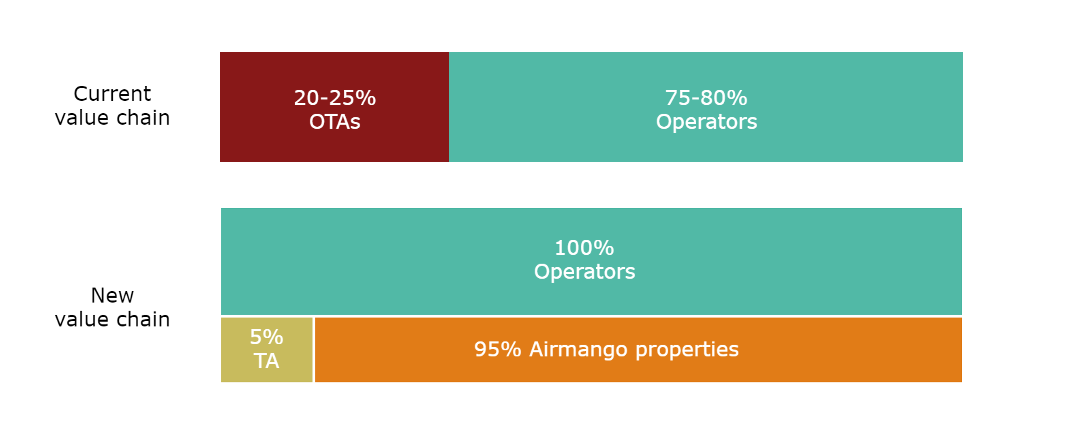

This has been possible due to its unique design, resulting in self-sustaining marketing and distribution – and our strategy of having no resellers (OTAs) that otherwise cut 20-30% from the total revenue in sales commission.

We have now redesigned the business model to disrupt the traditional value chain while still building on the base we know best and what makes us unique. In the pipeline, we now have four new brands of unique accommodation so we can fit our units in almost any location in the world. We’ve built up a web community platform to scale easier, and we are ready with a car rental operation to start creating new multi-day travel experiences with the help of Travel Architects.

However, we believe the existence of future travel companies will rely on finding ways to leave an impact. To do that, we are now seeking Euro 500k to 2.5 mln in equity to develop a new disruptive business model. We will use the funds raised on Funderbeam to develop our business opportunity and also find new investors who are interested in helping us build in their country by having access to land, expertise, or other potential resources we might need.

Problem

It is a well-known fact that we are facing a catastrophic climate change scenario if we do not find a way to reach “drawdown” – the future point in time when levels of greenhouse gases in the atmosphere stop climbing and start to decline steadily.

What needs to be done is also well-known. There are hundreds of potential solutions individuals and businesses can take to reach this stage quickly. Businesses’ existence in the future will depend on real action that actually has an impact. Individuals will increasingly select businesses that are working to help everyone move in this direction. Time is the most important variable.

However, we are seeing a lack of real action. Important goals set by monitoring organisations such as the United Nations are far from being reached. This is due to many things. Most importantly, people are “used to doing things as they are,” and there is a lack of capital to make the necessary investment to make the changes – these are the most common excuses.

So far, most of the “calls to action” have been based on the goodwill of the citizens. Simply telling people what they can do and hoping they will do it. However, it is not happening at the speed needed for material change that matters. Organisations have appealed to the moral sense of right and wrong as a way to change things. That’s great, and things are moving in the right direction – but not fast enough. An acceleration is needed based on a real incentivising structure.

This is the core of the problem identification that our business model will focus on. There is no incentivising system for the travel sector, and that is what we want to create.

Solution

Our focus for creating the missing incentivising system is a zero-commission strategy.

The zero-commission strategy means that every travel operator that the Travel Architects select for our multi-day travel experiences will not need to pay the usual 20-30% sales commission. This can be any accommodation type, activity operator, restaurant, or whatever the Travel Architect fits in to create the best travel experience.

This gives us the opportunity to build the first Green Acceleration Engine (GAE) in the travel sector. All these travel operators will be able to move up in ranking based on how well they improve their operations regarding climate change, sustainability, and biodiversity. We will be building up our own Green Acceleration Engine Optimisation guide to explain the potential opportunities.

The ranking algorithm we will develop will be based on verified and unverified information. We can source the verified information from data collected from platforms such as the Klappir Sustainability Platform and similar and unverified information direct from the travel operator that will only be validated by customer review. The verified information will help travel operators many times more in their ranking than unverified information.

To be able to do this disruption of the value chain (bæta hér yfirlitsmynd hvernig við breytum value chain), we need to get our revenue stream from two main sources that we will build up:

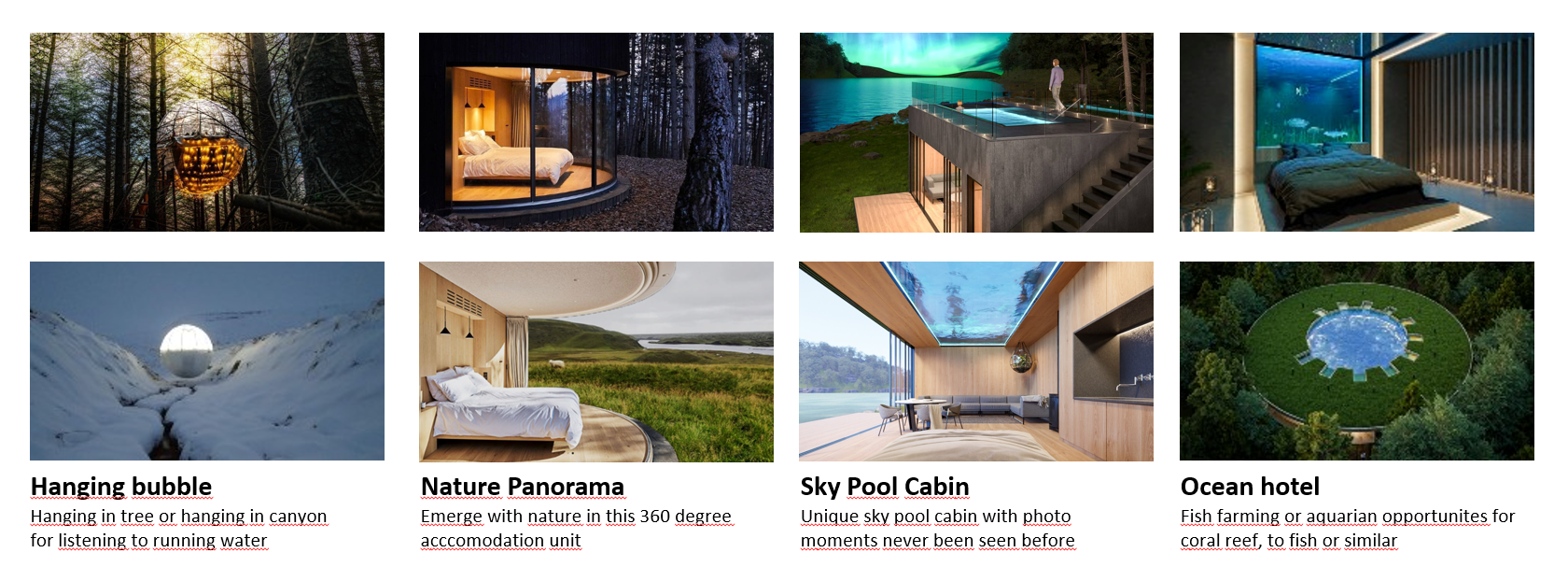

Unique Accommodation

We plan to build up more unique brands so we can fit one of our units into almost any type of location around the world. These brands will be developed from scratch in our lab, pre-fabs others have developed or re-purposed units so that they fit our connection with nature focus. These units will be 100% owned by Airmango but with a bonus system for local operators.

Tesla Car rental

We need to have our own car rental to operate a multi-day travel experience and provide valuable zero commission business opportunities for other travel operators. This is the core behind our Green Acceleration Engine.

Today we own the first 100% electric vehicle rental in Iceland. Even though it is still a very small fleet, we have gained valuable experience operating it here in Iceland´s harsh winter conditions last year.

In the near future, Tesla’s up and coming development will fit well for a “vehicle-as-a-service” that is ideal for our operation. It means we will have the opportunity at later stages to utilise a worldwide fleet of Teslas owned by individuals for our Travel Architects multi-day travel experiences by adding a package-based premium on top of the market rate.

Market

Total Addressable Market (TAM)

It is a challenge to define precisely the tourism industry as there is not one clear product. It includes lodging, transport, attractions and more. In its broadest sense it contributes 4.6 trillion to the global GDP in 2020 (Statista) Taylor will add here two more paragraphs on TAM after eastern where she will narrow down the analysis.

Market entry: Disruption of value chain

The WHY is the most important mover of all. People look at that before anything else (HOW and WHAT). The reason why most travel operators would want to start working with us is based on this simple move and disruption of the value chain.

We build our entry mode on a network of travel operators wanting to participate. The key source of reasoning will be based on WHY. We will need help from branding experts after funding.

Growth strategy: social platform

We will be building our growth strategy on a social community platform. Today, we are developing a simple-to-set-up platform primarily for learning about user behaviour. However, after fundraising, we will start a full-stack development. The main reasons we want to build up this type of platform are:

One of the key challenges for travel operators of all kinds is encouraging a recurring and loyal customer base. Before the business moved online, it was based on personal connections. However, this is now more of a challenge when everything is online. Developing a platform using the elements of habit-forming products will create more recurring business operations.

Sourcing and filtering of strong Travel Architects will be possible by focusing on two-level travel products. It will consist of the trip idea/travel blog type of element that everyone who wants to inspire us can create anywhere in the world and then the actual commercial travel product set up by the few selected winners. The community will be important for the wanna-be Travel Architects who want to showcase their talent on an ongoing basis.

Every commercial travel product we have will have its own social group created. Based on our experience, this helps the pre-purchasing support needed as former customers will help answer all types of questions. Having this in a community-based setting makes it possible.

Sourcing and communicating new opportunities for travel operators wanting to improve their ranking in our Green Acceleration Engine will be best accomplished on a social community platform.

Competition

When looking at the competition in the travel sector the following brands represent each segment fairly well. These are either competing directly or indirectly:

Regenerative Travel – Concept / vision

Nordic Visitors – multi day self-drive experiences

Booking.com / Airbnb and similar – large OTAs leaders for accommodation

Hertz / Avis and similar – large international car rentals

Unique value proposition

What makes us unique – a) unique accommodation development will be our core competence and b) we will develop the Green Acceleration Engine and c) social platform enabling others to participate. All this combined into one business model will create our USP.

Traction

Since being founded in 2016 we have had around 45-50k customers paying us over USD 10 mln in total for our unique travel experiences. The average transaction is around USD 1300.

We have had a global media exposure with over 1.1k referring domains and 6.1 mln search results on google. It has become a well known brand all over the world with 240k followers on social channels. According to SEMRUSH we are the 4th most sought after brand in the Iceland travel sectors. All done without any external investors or marketing / PR staff.

There has been a rough ride lately due to Covid-19 with the year 2020 as the first year hit with losses since we started in 2016. We have been able to turn the operation into profitable again in the year 2021 (see annual reports 2021) even if that year was still badly hit by Covid-19.

The historical financial performance and the future:

Stage I - Bootstrapped growth

We started on a shoe-string with less than USD 10k in cash to invest and were able to grow organically by reinvesting every penny of income. We went from the focus on product-market validation into running a rapidly growing operation with almost no overhead in very short time. We were probably one of Europe’s fastest growing bootstrapped travel startups between 2017-2018 with xxx% growth.

In the year 2019 we decided to slow down and stop reinvesting as we thought this was unsustainable in the long run and move into redesigning our business model for future growth. Later that year Iceland´s travel industry was hit by the bankruptcy of Wowair, the second largest local airline in Iceland. This was actually very good as it slowed things down and we were more ready when Covid then suddenly hit.

Stage II - Business model resilience validated

When the world is experiencing a level of disruption and business risk not seen in generations some companies freeze and fail. Others have designed a strategy on how to deal with this and thrive. We had plans for closing of the country due to volcano eruptions and similar risks for 2-3 months but never had we expected 1-2 years of downtime.

One of the advantages of focusing on multi-day travel experiences including our own transport is its focus on international travelers, as locals most often rely on their own way of transportation but incoming visitors need to rent a car or take part in guided tours. When the source of international visitors dried up due to Covid it was possible for us to open up for locals visitors having been a fairly underserved market segment. This is what we did when Covid hit and it worked fairly well.

In the first year of Covid we got hit like all other travel companies and we ran into our first year operating in losses. We however were able to turn it around and the year 2021 still having serious Covid measures most of the time, we were able to run in profit again.

Stage III - Upcoming growth stage

We have now used the time in Covid to redesign our business model as explained in this summary. We have set up a vision on what we want to build and why we want to do this. We are seeking investors believing in this vision and what we plan to build.

In the next stage we will validate our operational model here in Iceland with the clear purpose of getting it ready to be replicated all around the world in the upcoming years. We have only two multi-day travel experiences set up today and we plan to replicate this in hundreds with the clear focus on having an impact on the problem we are focusing on.

Team

Capital

Exit

Risk

Other

Investor instrument: Share unit

Investee company: New company (óstofnað)

Incorporation country: Iceland

Shares offered: Common Shares

Issued shares before: 100,000

Pre-money valuation: EUR 30,000,000 (ISK 4.1 milljarður)

Min target: EUR 500,000 (ISK 69 mln)

Min Lead investor commitment: EUR 300,000 (ISK 31 mln)

This can be a single investment from a private investor or a group in a syndicate

Planned investment amount: EUR 2,500,000 - 3,500,000 (ISK 344 - 482 mln)

Max investment amount: EUR 4,750,000 (ISK 655 mln)

Equity offered: 1.6% - 15.8%

If the campaign reaches at least €1.5 million, we have agreed on executing a minor founders’ cash-out of up to 9% of the total raised amount. That would be done to take off the financial pressures, ease their path to buying a home or paying back debt, and to keep the focus on long term goals of Airmango. This could total up to 1.3% of the founders’ shares.

Lead investor presentation open

We have finally reached the first version of the lead investor presentation. It is divided into description, terms and updates. We will update when things happen.

Lead investor presentation open

We have finally reached the first version of the lead investor presentation. It is divided into description, terms and updates. We will update when things happen.